how to lower property taxes in florida

Tax amount varies by county. Your property must qualify for the standard Homestead Exemption.

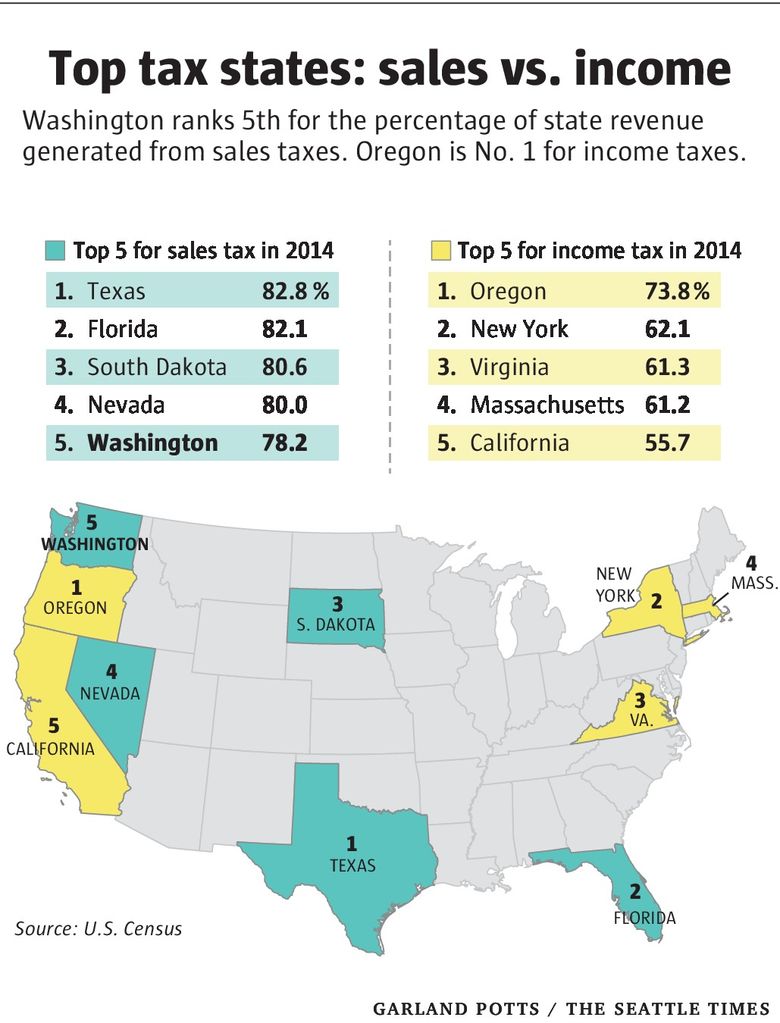

Taxes Like Texas Washington S System Among Nation S Most Unfair The Seattle Times

Property Tax Appeals for Palm Beach County Tel.

. At least one homeowner must be 65 years of age or older as of January 1st. We have attorneys well-versed in the Florida tax system to guide and instruct you on what is the best strategy to lower your property taxes. A tax appeal is the last resort for homeowners who want to lower their property taxes.

While you wont be able to contest the tax rate you will be able to. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The most significant potential exemption is the homestead exemption which could save you up to 15 on property taxes if you own your home in Florida and it is your primary.

Property taxes vary from county to county and the average property owner pays about US1700 in property taxes yearly. File a Tax Appeal. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the.

At Jurado Farshchian PL. Your assessed value cant increase by more than 3 or lower if the CPI is lower in that year 3. Online information - E-mail address.

3309 Northlake Blvd Suite 105 Palm Beach Gardens FL 33403. At an average home price of 156200 this amounts to. Florida is ranked 30th out of 51 including Washington DC when it comes to the highest tax rate in the United States.

The Tax Collector may have a program to assist you with deferring taxes and paying in quarterly installments. 097 of home value. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

In calculating the sales tax multiply the whole dollar. Even though market values didnt increase your assessed. Nonetheless there are a few ways that may be.

Posted at 2258h in Properties by Carolyn. 28 Feb The Consequences Of Floridas Property Tax Laws. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount.

In the state of Florida property taxes can only be increased by 3. You must have lived in the.

How To Lower My Property Taxes In Florida Learn More

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Sales Taxes In The United States Wikipedia

What Is Florida County Tangible Personal Property Tax

Florida S Agricultural Property Qualification And How To Qualify Property Tax Adjustments Appeals P A

Historical Florida Tax Policy Information Ballotpedia

Florida Snowbirds Challenge Fairness Of Two Tier Tax Wsj

The Cost Of Paradise We Pay Much More In Taxes To Live In South Florida Sun Sentinel

Tangible Personal Property State Tangible Personal Property Taxes

Florida Real Estate Taxes And Their Implications

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

Tangible Personal Property State Tangible Personal Property Taxes

Columbia County Tax Collector Proudly Serving The People Of Columbia County

Lower The Florida Property Tax For Commercial Buildings

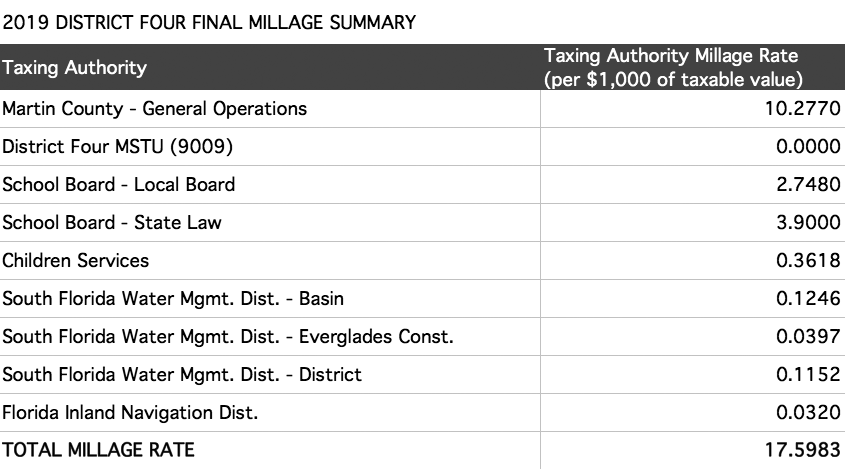

Are The Taxes Lower In Martin County Than Palm Beach County 2019 R R Realty Jupiter Real Estate

Florida Property Tax Consulting Firm Property Tax Consulant

How Can I Minimize My Property Taxes In Florida Florida Homestead Check